Private Insurance Coverage

After going off his parents insurance, Nate quickly chose a new insurance plan, but later realized it was a junk short-term plan, covering very little and with high copays and other costs. The providers of Nate's old plan were recently sued by the FTC for providing junk coverage, and he recieved money from the settlement.

After going off his parents insurance, Nate quickly chose a new insurance plan, but later realized it was a junk short-term plan, covering very little and with high copays and other costs. The providers of Nate's old plan were recently sued by the FTC for providing junk coverage, and he recieved money from the settlement.

Private Insurance Coverage

Holly and her family had employer-sponsered insurance through her husband's work, so they worried what would happen when her husband was laid-off. With the help of advance premium tax credits (APTCs) Holly's family has good, affordable coverage with tax credits to pay for monthly premiums.

Holly and her family had employer-sponsered insurance through her husband's work, so they worried what would happen when her husband was laid-off. With the help of advance premium tax credits (APTCs) Holly's family has good, affordable coverage with tax credits to pay for monthly premiums.

Private Insurance Coverage

Elizabeth has been living with Hodgkin's lymphoma since 2012. She was on Marketplace insurance, but the out-of-pocket and monthly costs were rapidly increasing. Elizabeth switched to her husband's employer-sponsored insurance and was able to not miss many treatment days. One of Elizabeth's major concerns is the rising cost of care for pre-existing and lifelong conditions.

Elizabeth has been living with Hodgkin's lymphoma since 2012. She was on Marketplace insurance, but the out-of-pocket and monthly costs were rapidly increasing. Elizabeth switched to her husband's employer-sponsored insurance and was able to not miss many treatment days. One of Elizabeth's major concerns is the rising cost of care for pre-existing and lifelong conditions.

Private Insurance Coverage

Avia began feeling symptoms similar to COVID-19. After visiting her doctor for testing, it came back positive. No treatment existed at the time of infection, and was told to stay hydrated and take Tylenol. Luckily, her insurance was able to cover all of her expenses.

Avia began feeling symptoms similar to COVID-19. After visiting her doctor for testing, it came back positive. No treatment existed at the time of infection, and was told to stay hydrated and take Tylenol. Luckily, her insurance was able to cover all of her expenses.

Private Insurance Coverage

Anna, immunocompromised, faced anxiety amid rising COVID-19 cases. Despite experiencing symptoms, she was initially discouraged from quarantine due to timing. While her test returned negative, symptoms persisted. Her insurance initially refused coverage for the test, relenting only after she advocated for herself on social media and had her story picked up by media outlets.

Anna, immunocompromised, faced anxiety amid rising COVID-19 cases. Despite experiencing symptoms, she was initially discouraged from quarantine due to timing. While her test returned negative, symptoms persisted. Her insurance initially refused coverage for the test, relenting only after she advocated for herself on social media and had her story picked up by media outlets.

Private Insurance Coverage

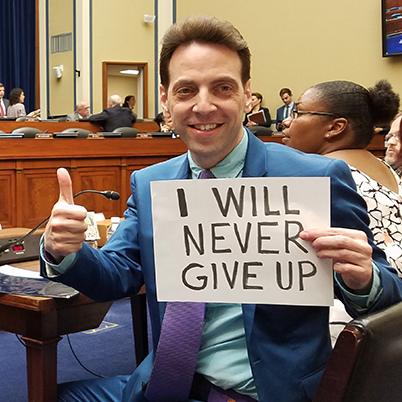

Peter has multiple conditions that require ongoing care and medication. He previously faced exorbitant medical bills prior to the enactment of the Affordable Care Act (ACA). Thanks to Medicare coverage facilitated by the ACA, Peter now has access to life-saving medications and procedures. He has become a staunch supporter and advocate of the ACA.

Peter has multiple conditions that require ongoing care and medication. He previously faced exorbitant medical bills prior to the enactment of the Affordable Care Act (ACA). Thanks to Medicare coverage facilitated by the ACA, Peter now has access to life-saving medications and procedures. He has become a staunch supporter and advocate of the ACA.

Private Insurance Coverage

Evens went years without health insurance, and was finally able to gain insurance through the ACA Marketplace. His cost-sharing plan allows him to pay half of what he used to. He feels relieved to know now that if something should happen, he's covered.

Evens went years without health insurance, and was finally able to gain insurance through the ACA Marketplace. His cost-sharing plan allows him to pay half of what he used to. He feels relieved to know now that if something should happen, he's covered.

Private Insurance Coverage

After years of putting off required surgery due to lack of coverage, Mary was able to get the surgery after receiving coverage through the Marketplace. For 14 years Mary was denied coverage due to a preexisiting condition, and those years were incredibly difficult for her to maintain good health. After becoming insured, Mary feels strong and able to access preventative care.

After years of putting off required surgery due to lack of coverage, Mary was able to get the surgery after receiving coverage through the Marketplace. For 14 years Mary was denied coverage due to a preexisiting condition, and those years were incredibly difficult for her to maintain good health. After becoming insured, Mary feels strong and able to access preventative care.

Private Insurance Coverage

When she started law school, Stephanie quit her job and no longer had employer-sponsored insurance coverage. She qualified for coverage while pregnant, but after suffering a miscarriage she was kicked off and left heartbroken with a $10,000 bill. After a long struggle, she was later able to gain insurance through the Marketplace and her children are covered through Medicaid.

When she started law school, Stephanie quit her job and no longer had employer-sponsored insurance coverage. She qualified for coverage while pregnant, but after suffering a miscarriage she was kicked off and left heartbroken with a $10,000 bill. After a long struggle, she was later able to gain insurance through the Marketplace and her children are covered through Medicaid.

Private Insurance Coverage

When Paul needed a lung transplant, he was uninsured because of his pre-existing conditions. He was told to undergo three months of dialysis before applying for Medicare and Medicaid. The ACA saved Paul and his children's lives and allowed him to apply for private insurance.

When Paul needed a lung transplant, he was uninsured because of his pre-existing conditions. He was told to undergo three months of dialysis before applying for Medicare and Medicaid. The ACA saved Paul and his children's lives and allowed him to apply for private insurance.

After going off his parents insurance, Nate quickly chose a new insurance plan, but later realized it was a junk short-term plan, covering very little and with high copays and other costs. The providers of Nate's old plan were recently sued by the FTC for providing junk coverage, and he recieved money from the settlement.

After going off his parents insurance, Nate quickly chose a new insurance plan, but later realized it was a junk short-term plan, covering very little and with high copays and other costs. The providers of Nate's old plan were recently sued by the FTC for providing junk coverage, and he recieved money from the settlement.

Holly and her family had employer-sponsered insurance through her husband's work, so they worried what would happen when her husband was laid-off. With the help of advance premium tax credits (APTCs) Holly's family has good, affordable coverage with tax credits to pay for monthly premiums.

Holly and her family had employer-sponsered insurance through her husband's work, so they worried what would happen when her husband was laid-off. With the help of advance premium tax credits (APTCs) Holly's family has good, affordable coverage with tax credits to pay for monthly premiums. Elizabeth has been living with Hodgkin's lymphoma since 2012. She was on Marketplace insurance, but the out-of-pocket and monthly costs were rapidly increasing. Elizabeth switched to her husband's employer-sponsored insurance and was able to not miss many treatment days. One of Elizabeth's major concerns is the rising cost of care for pre-existing and lifelong conditions.

Elizabeth has been living with Hodgkin's lymphoma since 2012. She was on Marketplace insurance, but the out-of-pocket and monthly costs were rapidly increasing. Elizabeth switched to her husband's employer-sponsored insurance and was able to not miss many treatment days. One of Elizabeth's major concerns is the rising cost of care for pre-existing and lifelong conditions. Avia began feeling symptoms similar to COVID-19. After visiting her doctor for testing, it came back positive. No treatment existed at the time of infection, and was told to stay hydrated and take Tylenol. Luckily, her insurance was able to cover all of her expenses.

Avia began feeling symptoms similar to COVID-19. After visiting her doctor for testing, it came back positive. No treatment existed at the time of infection, and was told to stay hydrated and take Tylenol. Luckily, her insurance was able to cover all of her expenses. Anna, immunocompromised, faced anxiety amid rising COVID-19 cases. Despite experiencing symptoms, she was initially discouraged from quarantine due to timing. While her test returned negative, symptoms persisted. Her insurance initially refused coverage for the test, relenting only after she advocated for herself on social media and had her story picked up by media outlets.

Anna, immunocompromised, faced anxiety amid rising COVID-19 cases. Despite experiencing symptoms, she was initially discouraged from quarantine due to timing. While her test returned negative, symptoms persisted. Her insurance initially refused coverage for the test, relenting only after she advocated for herself on social media and had her story picked up by media outlets. Peter has multiple conditions that require ongoing care and medication. He previously faced exorbitant medical bills prior to the enactment of the Affordable Care Act (ACA). Thanks to Medicare coverage facilitated by the ACA, Peter now has access to life-saving medications and procedures. He has become a staunch supporter and advocate of the ACA.

Peter has multiple conditions that require ongoing care and medication. He previously faced exorbitant medical bills prior to the enactment of the Affordable Care Act (ACA). Thanks to Medicare coverage facilitated by the ACA, Peter now has access to life-saving medications and procedures. He has become a staunch supporter and advocate of the ACA. Evens went years without health insurance, and was finally able to gain insurance through the ACA Marketplace. His cost-sharing plan allows him to pay half of what he used to. He feels relieved to know now that if something should happen, he's covered.

Evens went years without health insurance, and was finally able to gain insurance through the ACA Marketplace. His cost-sharing plan allows him to pay half of what he used to. He feels relieved to know now that if something should happen, he's covered. After years of putting off required surgery due to lack of coverage, Mary was able to get the surgery after receiving coverage through the Marketplace. For 14 years Mary was denied coverage due to a preexisiting condition, and those years were incredibly difficult for her to maintain good health. After becoming insured, Mary feels strong and able to access preventative care.

After years of putting off required surgery due to lack of coverage, Mary was able to get the surgery after receiving coverage through the Marketplace. For 14 years Mary was denied coverage due to a preexisiting condition, and those years were incredibly difficult for her to maintain good health. After becoming insured, Mary feels strong and able to access preventative care. When she started law school, Stephanie quit her job and no longer had employer-sponsored insurance coverage. She qualified for coverage while pregnant, but after suffering a miscarriage she was kicked off and left heartbroken with a $10,000 bill. After a long struggle, she was later able to gain insurance through the Marketplace and her children are covered through Medicaid.

When she started law school, Stephanie quit her job and no longer had employer-sponsored insurance coverage. She qualified for coverage while pregnant, but after suffering a miscarriage she was kicked off and left heartbroken with a $10,000 bill. After a long struggle, she was later able to gain insurance through the Marketplace and her children are covered through Medicaid. When Paul needed a lung transplant, he was uninsured because of his pre-existing conditions. He was told to undergo three months of dialysis before applying for Medicare and Medicaid. The ACA saved Paul and his children's lives and allowed him to apply for private insurance.

When Paul needed a lung transplant, he was uninsured because of his pre-existing conditions. He was told to undergo three months of dialysis before applying for Medicare and Medicaid. The ACA saved Paul and his children's lives and allowed him to apply for private insurance.